STP

This is the Single Touch Payroll tab. STP is how you report payroll and superannuation data to the ATO, and the company's details must be registered here to enable use of the STP process. For further information see "Company STP registration".

Once your company/s are registered for STP, this screen gives you the ability to override the BMS ID as well as provide your bureau details if you use the HR3 payroll software to provide payroll services to other companies.

Overriding a BMS ID

There are certain circumstances where it may be necessary to override the BMS ID that HR3 generates with another BMS ID. One such example is where a company transitions from one STP enabled payroll system (1st BMS ID) to another STP enabled payroll system (2nd BMS ID), part way through a financial year. If the company has already lodged STP PayEvents using the 1st BMS ID and wishes to load YTD balances into the new payroll system, then they cannot use a different BMS ID or the YTD values will be reported twice.

The scenarios around transitioning between STP enabled payroll systems are quite complex and therefore you will need to contact the HR3 payroll support team for advice on your options. To avoid the possibility of incorrectly overriding a BMS ID, this process requires an unlock key to be entered which only the support team can provide.

To override the BMS ID;

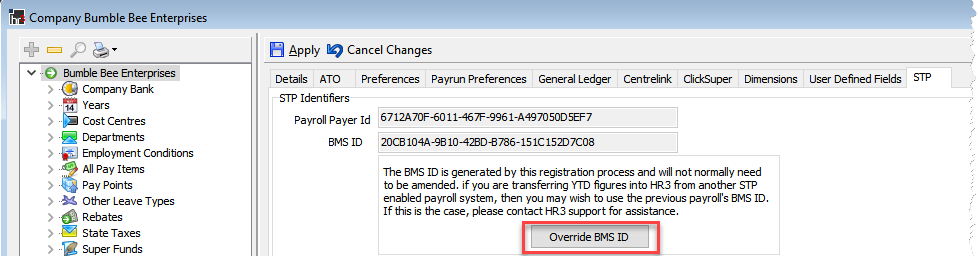

- Go to Navigator – Company – Maintain Company Details – STP. The following screen is displayed.

- Click on Override BMS ID. If you have contacted the HR3 support desk and they have confirmed that a BMS ID override is warranted, then you will be given the required Day Pass code.

- The BMS ID field will activated and you will be able to enter the BMS ID that you require.

Entering Bureau provider details

If you use HR3 payroll to provide payroll processing services on behalf of the listed companies then there are additional details that you will need to complete. In terms of STP, the ATO deems you to be an ‘Intermediary’ acting on behalf of your client companies.

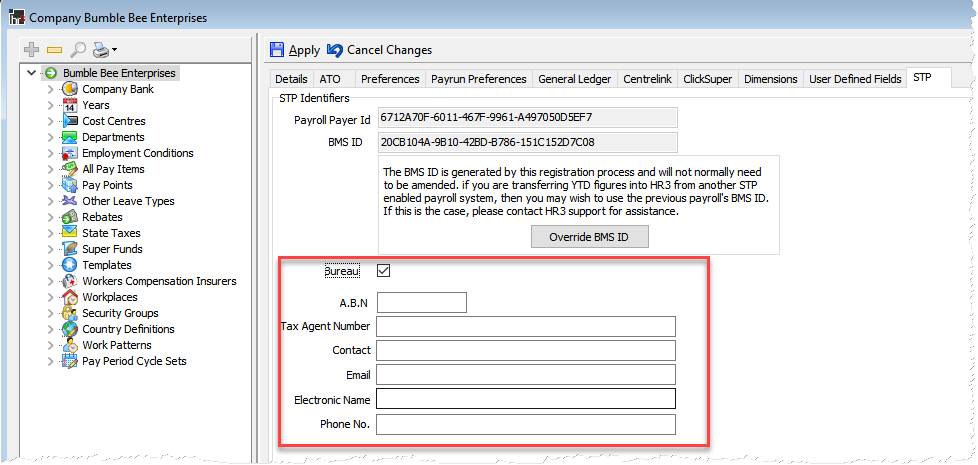

- To enter your bureau details go to Navigator - Maintain Company Details – STP and the following screen is displayed.

- Tick the Bureau checkbox and the extra Bureau fields will be displayed

- Enter the bureau provider ABN

- Enter the bureau provider’s Tax Agent Number

- Enter the Contact name

- Enter the contact’s Email address

- You can skip Electronic Name

- Enter the contact’s Phone No. and click Apply to save your changes for this company.

NOTE: If you have a large number of companies that you need to enter the same bureau details for, please contact the HR3 support staff as they can assist you to update the bureau details in bulk rather than doing them one company at a time.